All Categories

Featured

Table of Contents

Getting rid of representative settlement on indexed annuities permits for dramatically higher detailed and actual cap prices (though still considerably reduced than the cap rates for IUL plans), and no uncertainty a no-commission IUL policy would press illustrated and real cap rates greater. As an aside, it is still possible to have an agreement that is very abundant in agent settlement have high early cash surrender worths.

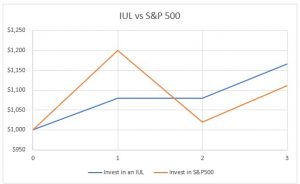

I will certainly yield that it is at the very least theoretically feasible that there is an IUL policy around provided 15 or 20 years ago that has delivered returns that are exceptional to WL or UL returns (a lot more on this listed below), yet it's important to better comprehend what an appropriate comparison would certainly require.

These plans usually have one bar that can be set at the firm's discernment annually either there is a cap price that specifies the maximum attributing rate in that certain year or there is an involvement rate that defines what percent of any favorable gain in the index will be passed along to the policy because particular year.

And while I usually agree with that characterization based upon the auto mechanics of the plan, where I disagree with IUL supporters is when they identify IUL as having remarkable go back to WL - index life insurance vs roth ira. Many IUL supporters take it a step additionally and indicate "historical" data that appears to sustain their cases

First, there are IUL policies around that lug even more danger, and based upon risk/reward concepts, those policies should have higher anticipated and actual returns. (Whether they actually do is an issue for major argument however companies are using this method to aid validate greater illustrated returns.) For instance, some IUL plans "double down" on the hedging approach and examine an added cost on the policy yearly; this fee is then utilized to enhance the choices budget plan; and after that in a year when there is a positive market return, the returns are enhanced.

What Is Index Life Insurance

Consider this: It is feasible (and in fact likely) for an IUL policy that averages an attributed price of say 6% over its initial one decade to still have an overall negative price of return throughout that time as a result of high charges. Many times, I discover that representatives or consumers that brag regarding the efficiency of their IUL policies are puzzling the credited rate of return with a return that appropriately shows all of the policy charges.

Next we have Manny's question. He states, "My good friend has been pressing me to buy index life insurance policy and to join her company. It resembles a multi level marketing. Is this a great idea? Do they truly make exactly how much they claim they make?" Allow me start at the end of the inquiry.

Insurance salesmen are not negative people. I utilized to market insurance at the beginning of my job. When they market a costs, it's not unusual for the insurance coverage firm to pay them 50%, 80%, even often as high as 100% of your first-year costs.

It's tough to market since you got ta constantly be looking for the next sale and going to locate the next person. It's going to be difficult to find a whole lot of gratification in that.

Allow's discuss equity index annuities. These things are preferred whenever the markets are in an unstable period. Right here's the catch on these things. There's, initially, they can regulate your behavior. You'll have abandonment durations, normally seven, 10 years, perhaps even beyond that. If you can not get access to your money, I recognize they'll tell you you can take a little percent.

How To Sell Indexed Universal Life Insurance

That's exactly how they know they can take your cash and go completely invested, and it will certainly be fine since you can't get back to your cash until, once you're right into 7, ten years in the future. No issue what volatility is going on, they're probably going to be fine from a performance standpoint.

There is no one-size-fits-all when it comes to life insurance policy./ wp-end-tag > In your active life, monetary self-reliance can seem like an impossible goal.

Fewer companies are providing typical pension strategies and numerous companies have reduced or terminated their retirement strategies and your ability to count only on social security is in concern. Also if benefits have not been decreased by the time you retire, social protection alone was never intended to be adequate to pay for the way of life you desire and are entitled to.

Universal Life Insurance Premium Calculator

Currently, that might not be you. And it is essential to understand that indexed universal life has a whole lot to provide people in their 40s, 50s and older ages, along with individuals that intend to retire early. We can craft a service that fits your details scenario. [video: An illustration of a man appears and his wife and child join them.

This is replaced by an illustration of a document that reads "IUL POLICY - $400,000". The document hovers along a dotted line passing $6,000 increments as it nears an illustrated bubble labeled "age 70".] Now, mean this 35-year-old man needs life insurance coverage to protect his family and a means to supplement his retirement revenue. By age 90, he'll have obtained practically$900,000 in tax-free earnings. [video: Text boxes appear that read "$400,000 or more of protection" and "tax-free income through policy loans and withdrawals".] And should he pass away around this time around, he'll leave his survivors with even more than$400,000 in tax-free life insurance coverage benefits.< map wp-tag-video: Text boxes appear that read"$400,000 or even more of defense"and "tax-free income with policy finances and withdrawals"./ wp-end-tag > As a matter of fact, throughout all of the buildup and disbursement years, he'll get:$400,000 or even more of defense for his heirsAnd the chance to take tax-free income with policy finances and withdrawals You're possibly questioning: Exactly how is this feasible? And the answer is basic. Interest is connected to the efficiency of an index in the stock market, like the S&P 500. The cash is not directly invested in the stock market. Interest is credited on an annual point-to-point segments. It can give you extra control, flexibility, and choices for your economic future. Like lots of people today, you might have access to a 401(k) or other retired life plan. Which's a terrific initial step towards saving for your future. It's crucial to comprehend there are limitations with qualified plans, like 401(k)s.

And there are restrictions on limitations you can access your money without penalties. Charges And when you do take money out of a qualified strategy, the cash can be taxable to you as earnings. There's a great reason numerous individuals are turning to this distinct service to address their financial objectives. And you owe it to on your own to see how this might help your very own individual situation. As part of an audio financial strategy, an indexed universal life insurance policy can aid

What Is The Difference Between Universal And Whole Life Insurance

you take on whatever the future brings. And it supplies unique possibility for you to build significant money worth you can make use of as additional income when you retire. Your money can expand tax postponed via the years. And when the plan is developed effectively, distributions and the fatality benefit won't be tired. [video: Text box appears that reads "contact your United of Omaha Life Insurance company agent/producer today".] It is essential to seek advice from a professional agent/producer who comprehends exactly how to structure a solution such as this effectively. Before dedicating to indexed global life insurance coverage, here are some advantages and disadvantages to think about. If you choose a good indexed universal life insurance policy strategy, you might see your money value expand in value. This is helpful since you might be able to accessibility this money before the strategy ends.

If you can access it early on, it may be advantageous to factor it into your. Considering that indexed universal life insurance calls for a specific degree of risk, insurer tend to keep 6. This sort of strategy additionally provides. It is still assured, and you can change the face quantity and riders over time7.

If the chosen index does not perform well, your money value's growth will certainly be impacted. Commonly, the insurance provider has a beneficial interest in executing better than the index11. There is typically a guaranteed minimum interest price, so your strategy's development won't fall listed below a certain percentage12. These are all aspects to be taken into consideration when choosing the very best sort of life insurance policy for you.

Given that this type of plan is much more complex and has an investment component, it can commonly come with greater costs than other plans like whole life or term life insurance. If you don't assume indexed global life insurance policy is best for you, below are some options to consider: Term life insurance policy is a short-term policy that usually uses insurance coverage for 10 to thirty years.

Iul Insurance

Indexed universal life insurance policy is a kind of policy that provides extra control and flexibility, along with higher cash value development capacity. While we do not offer indexed global life insurance policy, we can offer you with more information about whole and term life insurance policy plans. We advise exploring all your options and talking with an Aflac agent to find the very best suitable for you and your family.

The rest is included in the money value of the policy after fees are deducted. The cash money value is credited on a regular monthly or yearly basis with passion based upon increases in an equity index. While IUL insurance may prove important to some, it is essential to comprehend exactly how it works before purchasing a plan.

Latest Posts

Universal Life Insurance Premium Calculator

Universal Life Tools

Universal Life Vs Whole Life Which Is Better